Featured

Table of Contents

While new credit can assist you restore, it is necessary to area out your applications. If you have a member of the family or good friend with outstanding debt, consider inquiring to add you as a licensed individual on one of their charge card. If they do it, the complete background of the account will be included in your credit history records.

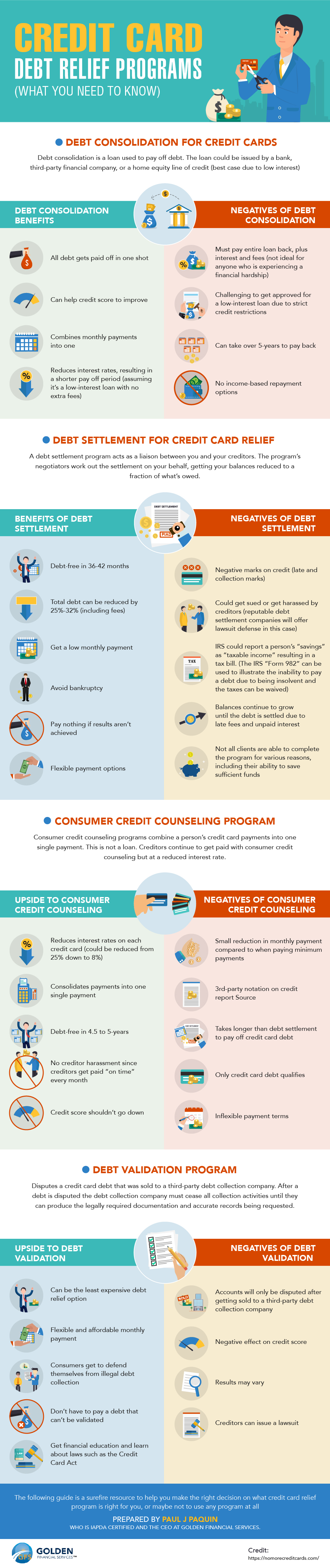

Prior to you consider financial obligation settlement or personal bankruptcy, it's important to understand the possible advantages and disadvantages and just how they might apply to your circumstance. Both options can decrease or remove huge portions of unsecured financial obligation, assisting you stay clear of years of unmanageable repayments.

If you're not exactly sure that debt settlement or personal bankruptcy is best for you, below are a few other financial obligation alleviation alternatives to think about. Properly will certainly rely on your circumstance and objectives. If you have some adaptability with your spending plan, right here are some accelerated financial debt settlement choices you can pursue: Beginning by detailing your financial obligations from the smallest to the largest balance.

The Buzz on How How to Build an Emergency Fund While Paying Off Debt Guarantees Ethical Compliance

The therapist negotiates with financial institutions to reduced rate of interest prices, forgo late charges, and create a manageable regular monthly payment. You make one consolidated payment to the firm, which after that pays your monetary establishments. While a DMP does not lower the major balance, it helps you settle financial obligation faster and much more affordably, generally within three to 5 years.

While you can discuss with lenders by yourself, it's typically a complicated and lengthy procedure, especially if you need to solve a huge quantity of debt throughout numerous accounts. The procedure calls for a strong understanding of your finances and the financial institution's terms along with confidence and determination. For this reason, there are financial debt alleviation companies likewise called financial debt negotiation firms that can deal with the settlements for you.

People who enlist in the red alleviation programs have, usually, roughly $28,000 of unsecured financial obligation throughout nearly 7 accounts, according to an evaluation appointed by the American Association for Debt Resolution, which considered customers of 10 major financial obligation relief business in between 2011 and 2020. Regarding three-quarters of those clients contended least one financial debt account efficiently cleared up, with the normal enrollee resolving 3.8 accounts and majority of their signed up debt.

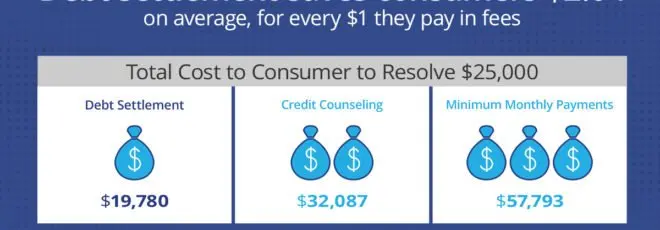

It prevails for your credit history to fall when you first start the financial debt alleviation process, especially if you stop paying to your lenders. As each debt is resolved, your credit report rating must start to rebound. Make sure you understand the overall prices and the impact on your credit when reviewing if financial debt settlement is the ideal choice.

Excitement About Steps to Take to Rebuild Your Life

As pointed out over, there are choices to financial obligation settlement that may be a far better fit for your economic situation. This technique transforms multiple financial obligations right into a solitary regular monthly payment and frequently offers a reduced rate of interest price, simplifying your funds and potentially conserving you money over time.

Right here's exactly how each one jobs: Debt loan consolidation finances: These are individual finances that you can utilize to settle your existing financial obligations, leaving you with just one regular monthly bill, normally at a lower passion price. Equilibrium transfer bank card: This includes relocating your existing credit scores card equilibriums to a brand-new credit rating card that supplies a lower rates of interest or a promotional 0% APR for a collection duration.

When the duration finishes, rates of interest will be substantially high frequently over 20%. Home equity fundings or HELOCs (home equity credit lines): These finances permit you to borrow versus the equity in your house. You get a round figure or a line of debt that can be made use of to settle financial debts, and you commonly take advantage of reduced rates of interest contrasted to unprotected fundings.

Getting My Things to Avoid When Researching a How to Build an Emergency Fund While Paying Off Debt Provider To Work

These strategies have a number of benefits, such as simplifying your payments by settling numerous into one and potentially minimizing your rate of interest. Yet they commonly come with a configuration cost varying from $30 to $50, and a month-to-month maintenance fee of around $20 to $75, depending upon the company you collaborate with.

Having a lot of financial debt can be frustrating, yet it's still vital to take the time to take into consideration the information of different remedies so you understand any potential dangers. The finest financial debt strategy for you depends on your financial circumstance. If you're fighting with your bills yet still have not missed any payments, a financial obligation administration strategy may be a great fit specifically if you do not want your credit history score to container.

Whichever your scenario is, think about talking to a licensed credit history therapist, a personal bankruptcy attorney, or a licensed financial obligation expert before moving on. They can help you obtain a full understanding of your finances and choices so you're far better prepared to choose. An additional factor that affects your options is the kind of debt you have.

It is necessary to understand that a discharge stands out from financial obligation forgiveness, and debt does not get "forgiven" with an insolvency declaring. Our West Palm Beach insolvency attorneys can clarify in more detail. In basic, "financial debt mercy" describes a scenario in which a financial institution does not think it can accumulate the sum total of the financial debt owed from a borrower, and either stops attempting to collect or agrees to forgive an amount less than what the debtor owed as component of a financial obligation negotiation agreement.

The Basic Principles Of Developing a Stable Spending Strategy That Works

When this occurs, the financial obligation will be considered "canceled" by the internal revenue service, and the debtor will typically obtain a termination of financial obligation create the quantity of financial debt forgiven is taxable. In an insolvency situation, financial obligation is not forgiven by a lender. Rather, it is released by the insolvency court, and discharge has a different significance from financial obligation mercy.

Table of Contents

Latest Posts

Staying Away From the Same Mistakes After Debt Relief Fundamentals Explained

Not known Details About Does Bankruptcy Appropriate for Your Family

The smart Trick of Necessary Records When Pursuing Debt Forgiveness That Nobody is Talking About

More

Latest Posts

Staying Away From the Same Mistakes After Debt Relief Fundamentals Explained

Not known Details About Does Bankruptcy Appropriate for Your Family

The smart Trick of Necessary Records When Pursuing Debt Forgiveness That Nobody is Talking About